The global supply chain has taken a strong hit from the Covid 19 pandemic, and it is undergoing what may be termed “The Long COVID Syndrome.” Some economists are suggesting that this “long COVID” impact on some of the facets of the supply chain could last through 2023.

WHAT IS A SUPPLY CHAIN?

A supply chain is defined as the entire process of making and selling commercial goods, including every stage from the supply of materials and the manufacture of the goods through to their distribution and sale.1 It consists of many elements –from manufacturing sites and warehouses to transportation, inventory management, and order fulfillments.

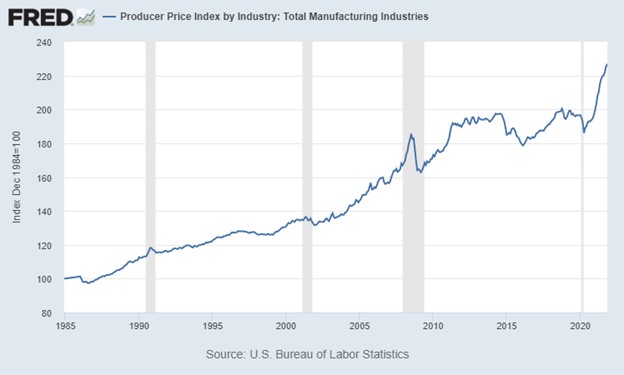

The COVID pandemic brought to light any weaknesses in the supply chain and worsened those conditions. The lockdowns in workplaces, the time lost because of illness and, in some cases, deaths among workers have led to a scarcity of labor and significant shortages of components and materials globally. Also, skyrocketing freight costs, delayed shipments, and the sharply rising cost of oil have led to higher costs for virtually all categories of commodities (Figure 1.)

This graph shows the massive escalation of costs/inflation and demand for all manufacturers over the past 12 months. Source: https://fred.stlouisfed.org/series/PCUOMFGOMFG/.

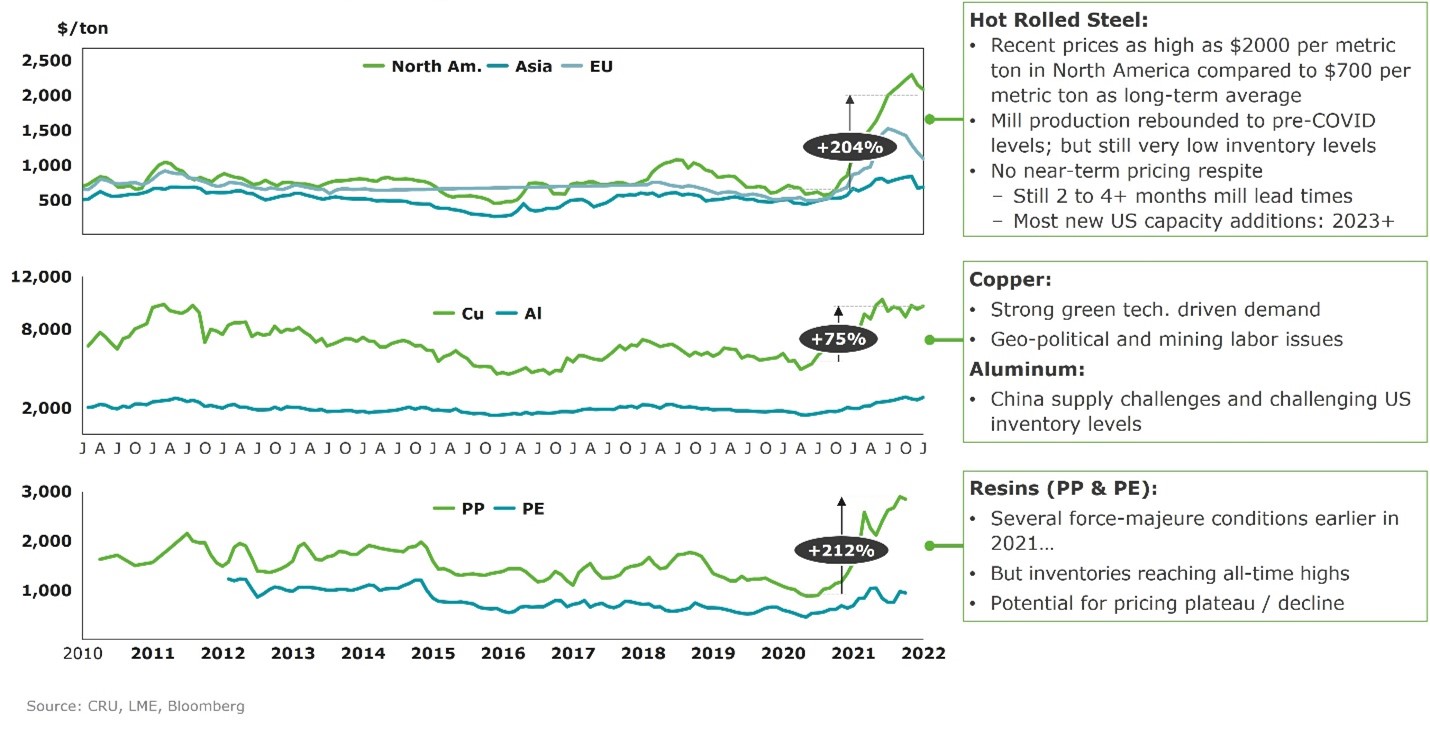

We member companies of the Fire Apparatus Manufacturers’ Association (FAMA) are seeing these higher costs in the various components needed for manufacturing fire apparatus1 (see Figure 2).

Figure 2. For many raw materials, supply shortages led to near- record high prices with little near-term relief.

Source: CRU, LME, Bloomberg

SUPPLIES NOT ACCESSIBLE

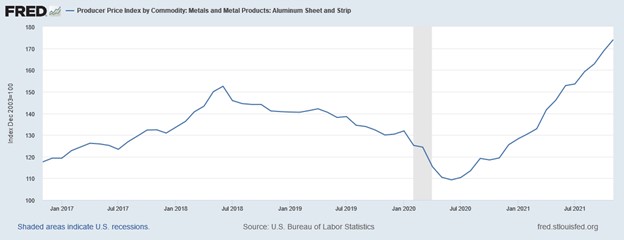

In addition, compounding challenges are posed by overtaxed ports: The supply is there, but the ships docked offshore cannot be offloaded. The uncertainty surrounding the availability and pricing of products in this “new normal” marketplace poses significant stress for manufacturers and consumers. FAMA member companies are not immune to these negative economic effects. These circumstances are affecting supplies ranging from complete chassis to aluminum (Figure 3), stainless steel, and polymer-based tanks to the thousands of components that make up a fire truck.

Figure 3. Producer Price Index by Commodity: Metal and Metal Products—Aluminum Sheet and Strip

The resulting upward price swings sweeping through the supply chains ultimately affect our customers. Just as consumers have been seeing these increasing costs in practically every category of goods they purchase—in the dairy and meat departments in their grocery store and at the gas pump, for example, fire apparatus manufacturers and suppliers are seeing them in valves, fittings, and other components used to construct fire apparatus.

MANUFACTURERS AND OTHER SUPPLIERS REACT TO CHALLENGES

“In today’s turbulent environment, companies must rethink certain supply chain fundamentals to maximize revenue and margin,” note Dan Hearsch and Gerrit Reepmeyer of the consulting firm AlixPartners. Among them is “balancing strong demand with massive supply chain disruptions and slim inventories.” In the present marketplace environment, they say: “Cost has taken a back seat to supply security.”2

As Figure 2 shows, these disruptions have occurred on many levels.

- Commodities: Raw materials, such as steel, aluminum, copper, resin, tin, magnesium, or many others, are in short supply and are seeing price spikes. In many cases, there have been physical shortages of materials as well. Prices are expected to come down for some materials, but fundamentals do not indicate an immediate relief.2

- Freight. Costs have increased substantially across domestic trucking; international air freight; and, particularly, international ocean freight. “A mismatch of container and ship locations, and a throttling down of port throughput means freight bottlenecks will continue to plague supply chains.”2

- Containers. In September 2021, Tom Quimby, senior editor of Commercial Carrier Journal, reported the following: “As much as a 445 percent increase in container costs is hitting the supply chain just as ports are dealing with months-long backlogs and suppliers are managing historically high demand. All this adds up to higher prices and continued shortages, with no end in sight …. The situation at ports and at sea threatens to send tidal waves through consumer prices.”3

According to Quimby, an administrator in a major trucking supply company, on the condition of anonymity reported the following: ‘The rules in the import game have changed.

This means no more COD payments for imported containers (they must be prepaid) and no more guarantees of getting a spot on a freighter.’ This administrator reported also seeing a 445 percent uptick in import container costs, which, he said, will be passed along to customers. This administrator’s company imports equipment used by trucking companies throughout the United States.3

Beside higher prices for truck parts, suppliers must be concerned about availability. Some companies are doubling up on orders because of the supply chain constraints. China’s closure of port terminals because of concerns about the spread of COVID-19 has exacerbated the supply issue.3

- Labor. For many companies, keeping output up has been a big challenge. A FAMA member company component supplier lost 27 percent of its direct labor workforce since the start of 2020. It has offered new benefits, incentives, and increased wages along with other initiatives to maintain workforce retention and help recruitment. The recovery back to pre-COVID levels will likely extend well into 2022 in the United States, given the demand for labor, driven by the demand for goods and loss of workforce availability.2

FAMA Member Companies’ Response

Every company is grappling with some facets of this global supply chain situation. FAMA member companies are working to address this issue in various ways, including the following.

- We have established multifunctional teams to oversee procurement, finance, scheduling, manufacturing, and sales. Specifics on this action and the following actions will be made available to the fire industry in a FAMA White Paper, which will be available shortly.

- We believe that transparency builds and preserves trust. Therefore, we are communicating our capacity to strategic customers on a regular basis. Also, companies have implemented programs that allow for real-time tracking of work in progress (WIP) within our production facilities.

- Some FAMA member companies that provide fire truck components, when faced with uncertainty relative to the availability of raw materials, have looked internally at their designs for alternative methods and fabrication techniques that can be changed without lowering performance and integrity standards–for example, piping parts for internal plumbing. They have instituted improvements to flow lines that have been overshadowed by material cost and attrition.

- FAMA member vendors have reached out to other suppliers and are assisting each other when geographic borders put restrictions on travel—for example, a reciprocal agreement for service on occasion because of Canadian- United States travel.

Just as important, we FAMA member companies are reaching out to each other and to you for moral support; all of us share the same challenges.

EARLY ACTION HELPS CUT WAITING TIME

We have all heard stories related to the supply chain impact on the automotive sector, which produces millions of vehicles a year. Car lots are virtually empty. Automobile dealerships are on allocation; as a result, used vehicles are selling at record prices. The commercial truck and trailer market, representing hundreds of thousands of new vehicles per year, has so much pent-up demand that many manufacturers have stopped accepting new orders. To put things into perspective, the fire industry represents fewer than 5,000 new builds per year.

Consequently, when the supply chain conditions begin to improve, the fire industry will be in a long line behind larger sectors of the automotive sector, which has significantly more purchasing power than our industry. Supply chain constraints and inflationary pressures are long-term trends, not blips.

Fire departments wishing to maintain the capabilities of their existing fleets and take advantage of emerging technologies should secure their production slots at today’s pricing. Failing to act will subject them to higher costs and longer delays in delivery of their vehicles and trucks.

FAMA is committed to the manufacture and sale of safe, efficient emergency response vehicles and equipment. FAMA urges fire departments to evaluate the full range of safety features offered by its member companies.

FAMA Forum creative content is contributed by unpaid volunteer authors. Any opinions expressed herein are exclusively those of the author and are not intended to represent the views of FAMA or its member companies.

References

- What is supply chain? A definitive guide. (supplychaindigital.com) Supply Chain magazine is the ‘Digital Community’ for the global Procurement, Supply Chain & Logistics industry.

- “Managing Supply Chain Turbulence,” Nov. 2021; https://www.alixpartners.com/about-alixpartners/ AlixPartners is an American consulting firm headquartered in New York, NY.

- 3. “Container cost surge of 445% collides with constrained supply chain,” Tom Quimby, senior editor, Commercial Carrier Journal, Sept. 18, 2021; High container costs and constrained supplies pushing up prices on parts | Commercial Carrier Journal (ccjdigital.com)

The following have contributed to this column: Jason Darley (North American Sales Manager, Darley), Andrew Lingel (President, United Plastics Fabricating, Inc.), Oran McNabb (President, AMDOR).